|

National Credit Union Administration

Agencies Issue Exemption Order to Customer Identification Program Requirements

The NCUA issued a joint order, along with the other federal financial institution regulators, which grants an exemption in certain circumstances from a requirement of the Customer Identification Program (CIP). This exemption provides flexibility for credit unions which comply with the CIP rule. The exemption is voluntary and does not change the underlying requirement for credit unions to have risk-based CIP procedures that enable them to form a reasonable belief that they know the true identity of each member.

NCUA Opens Registration for Credit Risk Webinar

The NCUA will host a webinar on July 15, 2025, which focuses on credit risk. The session will highlight credit risk-related information that may be relevant to boards of directors and credit union management teams to help identify, monitor, and respond to credit risk within their credit unions.

The webinar will feature a discussion of current trends in credit union lending and credit performance, as well as observations from recent examinations. Topics will include:

NCUA Releases Updated Guidance on Referrals for Potential Criminal Enforcement

The update is in response to the Presidential Executive Order which directs federal agencies to scale back the use of criminal penalties for regulatory violations. The notice provides a general policy the NCUA will follow in determining whether to refer alleged violations of criminal regulatory offenses to the Department of Justice (DOJ). Factors the NCUA will consider include:

|

League InfoSight Highlight |

|

Small Business Lending Rule Delayed Again

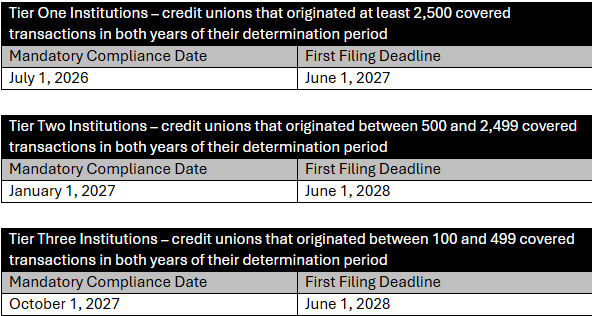

Reminder, the Consumer Financial Protection Bureau (CFPB) published an interim final rule extending the mandatory compliance dates once again for its small business lending data collection rule.

The new mandatory compliance dates and first filing deadlines are as follows:

|

|

|

With the extension of the mandatory compliance dates, the interim final rule also clarifies that a credit union may use any of the following for its determination period:

The CFPB indicates that it plans to use this additional time to initiate new rulemaking, which we anticipate will make significant changes to the current small business lending data collection framework. The agency says that it “anticipates issuing a notice of proposed rulemaking as expeditiously as reasonably possible.”

|

|

|

|

ARTICLES OF INTEREST |

|

Treasury Issues Unprecedented Orders Under Powerful New Authority to Counter Fentanyl

Agencies Release List of Distressed or Underserved Nonmetropolitan Middle-Income Geographies

Agencies Request Comment on Proposal to Modify Certain Regulatory Capital Standards

Treasury Launches New FinCEN Exchange Series to Combat Narcotics and Drug Trafficking Organizations

Gardner v Flagstar

CFPB’s No FEAR Act Annual Report for Fiscal Year 2024

Down to the Wire. Is Your Credit Union Ready for Fedwire’s ISO 20022 Adoption?

|

|

|

SCAM UPDATES |

|

Welcome to Military Consumer Month 2025

Scammers Are Impersonating Local Law Enforcement

Are You Really Out of Cloud Storage or is That Message a Scam?

|

COMPLIANCE CALENDAR |

|

|

July 14, 2025: Effective Date – FTC Negative Option Rule

July 15, 2025: NCUA Credit Risk Webinar

Sept. 18, 2025: FDIC, FRB, Treasury, OCC – Request for Comment on ways the agencies can take action collectively or to help consumers, businesses, and financial institutions mitigate check, automated clearing house (ACH), wire, and instant payments fraud.

Oct. 1, 2025: Quality Control Standards AVMs

Dec. 30, 2025: CFPB: Overdraft Lending: Very Large Financial Institutions (Over $10 billion)

Jan. 1, 2026: NCUA – Succession Planning Effective Date

March 1, 2026: CFPB: Residential Property Assessed Clean Energy Financing (Reg Z)

April 1, 2026: Compliance Date – CFPB Personal Financial Data Rights for Credit Union’s Over $10 Billion in Assets

June 19, 2026: NACHA – Fraud Return Reason Code

July 1, 2026: CFPB – Small Business Lending Data – ECOA

Dec. 12, 2026: NCUA Simplification of Share Insurance Effective Date

|

|

TOOLS & RESOURCES |

|

|

|

|

|

|

|

|

Q&A OF THE WEEK |

|

|

Do we have to send an adverse action notice when we terminate a credit card account due to delinquency?

No, if an account is terminated due to inactivity, default, or delinquency, according to the terms of the card agreement, it is not considered adverse action and you do not have to send an adverse action notice.

|

|

|

|

|

For your individualized login, select your state below. |

|

|

|

|

|

|

|

|

|

|

If you have questions about this communication, contact us at 800.546.4465 or via our shared email inbox at compliance@gowest.org.

Have a great weekend!

Your GoWest Compliance Team, |

|

|

|

|

|

David Curtis

CUCE

Director, Compliance Services

P: 206.340.4785 |

|

|

|

|

|

|

Copyright © 2025 GoWest Credit Union Association. All Rights Reserved.

Mailing Address:

GoWest Credit Union Association, 18000 International Blvd Ste. 1102, SeaTac, WA 98188, United States

1.800.995.9064

View in Browser | Manage Your Preferences | Unsubscribe |

|

|

|

|